In today’s digital economy, more small and medium-sized enterprises (SMEs) are exploring cryptocurrency as a payment method. Crypto adoption is growing rapidly in both Southeast Asia and the United Kingdom, but one barrier remains: volatility. Price swings in Bitcoin (BTC), Ethereum (ETH), and other tokens can wipe out profits in minutes — a risk most SMEs cannot afford to take.

This is where Cryptogram.vip makes a difference.

Understanding the Volatility Problem

Traditional wallets allow businesses to accept and hold cryptocurrency, but they expose merchants to constant market swings. Imagine a UK-based e-commerce store accepting a $500 BTC payment. If Bitcoin’s price drops 10% before conversion, the business effectively receives only $450.

In the Philippines, where SMEs rely heavily on cash flow and slim profit margins, even small fluctuations can hurt day-to-day operations. With over $40 billion in annual remittance inflows, crypto payments are attractive — but the volatility risk has discouraged wider adoption.

How Cryptogram Wallet Solves It

Cryptogram.vip Wallet is designed specifically for businesses, not just individual crypto users. Its standout feature is value-locking technology, which instantly locks the value of a transaction at the time of payment.

This means:

- A merchant in Manila can accept a ₱10,000 payment in ETH. The wallet locks the exchange rate immediately, ensuring the business receives the full ₱10,000 in their bank account — regardless of ETH price movements.

- A UK online retailer can accept £1,000 in BTC. Even if Bitcoin drops during processing, the merchant still receives £1,000 safely deposited into their account.

By bridging crypto and fiat in real time, Cryptogram.vip removes the uncertainty that has kept many SMEs on the sidelines.

Why Value-Locking Matters for SMEs

- Cash Flow Stability

SMEs operate on tight budgets. Predictable settlement ensures they can pay suppliers, salaries, and bills without worrying about overnight crypto price crashes. - Trust & Adoption

Businesses can confidently market “We Accept Crypto” knowing they won’t lose money on volatility. This builds trust with customers while maintaining financial security. - Competitive Edge

Merchants using Cryptogram.vip gain a first-mover advantage in crypto-friendly markets like the Philippines, UAE, and the UK, where digital payments adoption is accelerating.

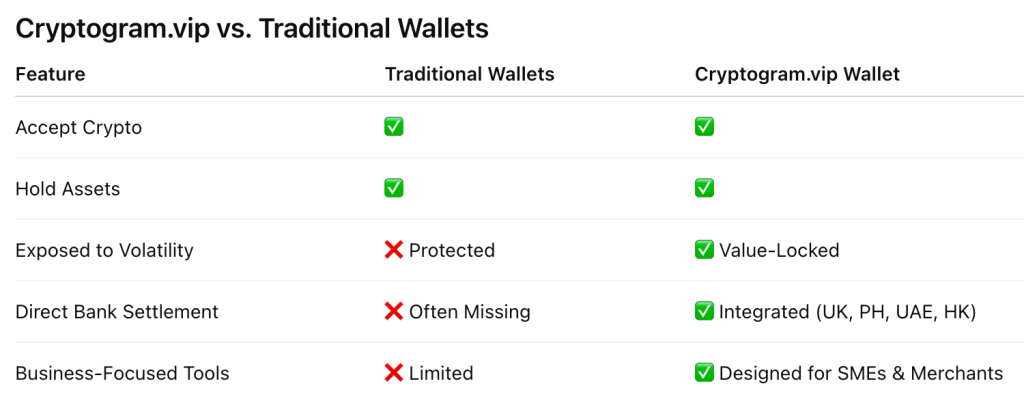

Cryptogram.vip vs. Traditional Wallets

Traditional wallets are useful for traders, but they don’t solve the volatility problem for businesses. Cryptogram.vip was built with SMEs in mind, ensuring that crypto becomes a practical, risk-free payment method.

Real-World Scenarios

- Philippines SME: A local café in Manila accepts a ₱500 payment in BTC through Cryptogram.vip. The wallet locks the rate instantly, converting it to pesos and settling it into the café’s bank account by the next day — risk-free.

- UK E-commerce Business: A retailer sells a £200 item online, paid in ETH. Even if Ethereum drops in price during the transaction window, the merchant still receives the full £200 in their bank account.

These scenarios highlight how Cryptogram.vip can turn crypto into a reliable business payment method, rather than a speculative gamble.

For crypto adoption to scale among SMEs, volatility must be eliminated. With its value-locking wallet and direct bank settlements, Cryptogram.vip delivers the solution businesses have been waiting for.

Merchants can finally embrace cryptocurrency with the confidence that they’ll be paid in full — every time.